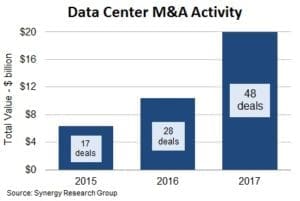

Data centers were a hot commodity in 2017. In fact, a report released by Synergy Research this week found that sales reached $20 billion, surpassing the totals of 2015 and 2016 combined.

Data centers were a hot commodity in 2017. In fact, a report released by Synergy Research this week found that sales reached $20 billion, surpassing the totals of 2015 and 2016 combined.

How active was the data center market last year? Synergy reports that there was at least one deal on average every single week of the year. The largest deal of the year by far was Digital Realty’s $7.6 billion acquisition of DuPont Fabros. That’s a hefty chunk of change, for sure, and twelve deals that were valued in the $100 million to $1 billion range. In the end, it all added up to that $20 billion figure.

This year really stood out in comparison with the previous two years with 48 deals in total (and another four major ones announced, but not closed by year end). Compare that with 2015’s 17 deals and last year’s 28 deals. The market simply exploded this year, as this chart clearly illustrates.

Follow the money

Digital Realty and Equinix have been the most active since 2015. For instance, Equinix bought 29 Verizon data centers in 2016 for $3.5 billion. This year, the company bought Metronode for $791 million to increase its presence in Australia. It also bought IO’s London data center for an undisclosed amount to pick up coverage in the UK.

Other more surprising companies like Iron Mountain also got involved. It bought IO Data Centers’ US operations for $1.3 billion at the end of the year. It also acquired the Fortrust data center in September and the previously announced acquisition of two Credit Suisse data centers in London and Singapore. And that’s just one company.

Iron Mountain, which has been mostly known a storage management vendor for physical and digital assets, has been moving into data centers, where it sees an opportunity to expand its market beyond its core storage business. They are seeing the same thing, these other vendors are, a market that needs these kind of facilities, but don’t want to invest outside of the core business.

You can see a list of the entire M&A activity last year here.

How this relates to the cloud

Data centers require a massive capital investment along with a team to manage them and it takes time and money away from whatever the company does, which surely isn’t running a data center.

Typically these data center vendors provide cooling, power, bandwidth, physical security, and overall management of the facilities, removing that burden from the customers.

This all relates to the cloud because even if companies don’t want to go to the major public cloud vendors like AWS, Microsoft and Google, they may want to get out of the data center business and these companies give them the opportunity to do that privately.

“Above all else, what is driving the data center M&A activity is enterprises focusing more on improving IT capabilities and less on owning data center assets,” John Dinsdale, chief analyst and research director at Synergy explained in a statement. With all this action, we can probably expect that trend to continue into next year.

Photo: Christopher Bowns on Flickr. Used under CC by SA-2.0 license.