Do you know if any of your customers are losing you money?

Do you know if any of your customers are losing you money?

It is often reported that any organisation’s profits follow the Pareto principle: 80 percent the profits come from the top 20 percent of the customers. Although this is a very broad stroke approach, it will do as a starting point for what follows.

Unfortunately, such an approach can also lead to issues when defining what this means for the business. The correlation is not a straight line with a drop followed by another straight line but a curve in how much profit you derive from each customer.

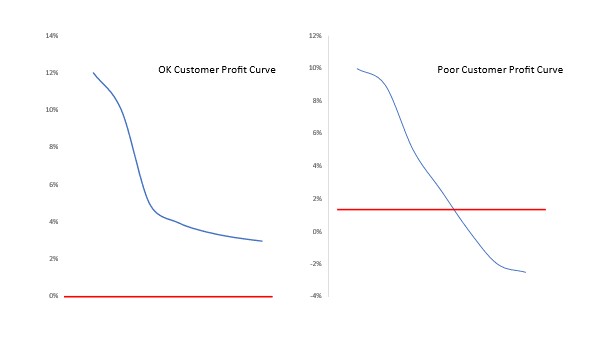

Figure 1: OK and Poor Customer Profit Curves

This may seem counterintuitive when looking at MSPs – after all, the majority now work on subscriptions which are based on a cost that is meant to cover everything being provided to the customer – while allowing room for a profit.

Some customers may not quite fit in with the calculations, though – and it is worth trying to find out who they are so that something can be done about them.

Know which customers are profitable

Figure 1 shows two hypothetical profit curves, with the red line denoting the zero-profit mark. Anything below this line is a customer making a loss for the MSP. The left-hand graph shows an OK customer profit curve – not perfect, but at least every customer is providing the MSP with a profit. For those on the ‘long tail’ of low profitability, MSPs can focus on ways to improve profitability through cross- and up-selling them with enhanced services available at the right price.

The right-hand graph, however, shows what can go wrong – most of the customers providing a profit – but a proportion where the reality is that they are posting a loss to the MSP.

Most of the customers posting a loss tend to be the smaller ones. Large customers will be paying enough to cover all the costs associated with managing their services – unless a ‘special’ deal has been offered by a direct salesperson doing whatever they deem necessary to close the deals at the end of a sales period.

Understand how support services and collections eat into profitability

It’s the small customers who can more easily suck up the overhead of the subscription fee. Here, the main costs tend to be around support. Small customers that haven’t got the ability, or can’t be bothered, to offer some form of first-level support in-house will often see an MSP as a cheap option. After all, support is included in the subscription, so why not just point every query at the MSP?

It is worth looking through help desk records and finding out if there are customers who are overusing the help desk – and analysing what sort of questions are coming through. Options then include providing a report to the customer on their use of the help desk, what common problems are being addressed on a regular basis, and then asking them (nicely) to ensure that users are made aware of the solutions to such problems before contacting the MSP’s help desk. Another approach is to charge the customer extra for support to elevate them to a profit-generating customer – they may not like this and may consider cancelling their subscription but losing an unprofitable customer should not be a major concern for the MSP themselves.

Other areas where losses may be accrued are poorly paying customers that require constant chasing for payment. They may well always pay up eventually, but it is necessary to consider the costs of tracking and chasing such customers.

Set minimum profit margins to mitigate loss

Even where the customer is a net no-loss for the MSP or is making some level of profit, this may not be enough to meet what the MSP requires. MSPs do not exist to just cover their costs and then add a little. Future investments must be considered, as well as external factors such as shareholder dividends and employee bonuses. After all, any customer that fails to meet such a baseline is essentially producing a loss to the MSP – ensuring that all overhead, not just the technical expenses – are included in calculations is a necessity. Any MSP must decide what the bare minimum profit margin should be from any customer – and analyse records to see which customers fall below this line.

Some of the challenges faced here may include a customer having orphan accounts or live images on the MSP’s platform. While the subscription that the customer is paying should cover this to a certain level, these unused items will be taking up resources that can be used to support more profitable customers. It may well be cost-effective to offer customers an analysis of usage, providing them with the capability to both free up such resources for the MSP’s use, as well as cutting down on the customer’s own costs – something that could be a win-win.

No MSP can ever hope to create a perfect environment where every customer provides the same level of actual profitability. The key is to ensure that minimum levels of profitability are hit by all customers and that the focus is not completely on the big, high-value, high-profit customers, but on those who are bleeding profit away from the business.

Photo: lovelyday12 / Shutterstock

This is an excellent exercise to run through for an MSP. In particular, during this process, consider the customers who are not only losing the MSP money, but also no longer a fit based on culture and priorities (like cybersecurity).

Great article about looking at your customer profitability.

Great article; Sharing with our team.

this is a great article, you need to recognize when you need to cut your losses and not be emotionally attached to client if they are milking your profit and costing you to keep them as a client. it tough but you need to say enough is enough to pay your bills

This is so critical when it comes time to increase pricing or add more resources.

This is a useful article, I particularly like the idea of having a minimum customer margin threshold. We have a saying that if something is sold at cost, it’s actually loss-making. Because even with the cost of billing platforms and direct debit collection these elements have an impact too.