Getting to $100 million in revenue is a pretty big deal for most SaaS companies. Getting to a billion is an entirely different level. Box is making steady progress toward that goal, and it continued its upward growth trajectory this week, announcing record revenue in its latest earnings report.

A billion in today’s world may not seem like a big deal, especially when you consider Salesforce reported over $3 billion in revenue for a single quarter this week, but you can’t compare everyone to the top of SaaS heap. Salesforce is in a different revenue league than the rest of the SaaS world and that means you have to be more realistic about defining what success is.

Salesforce launched in 1999 and went public in 2004, a full year before Box was even founded by four college buddies. Box began life as a consumer app, but several years later made the conscious decision to switch to the enterprise.

An evolving platform

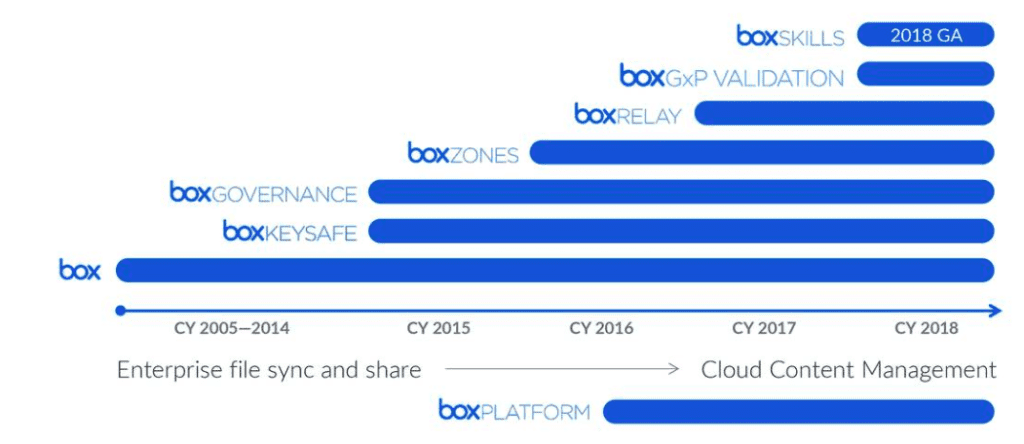

Over the years it has moved from a fairly basic file sync and share product to one that covers much broader enterprise content management needs in the cloud including local storage with Box Zones and encryption key management with Box KeySafe.

Graph: Box

These additional products have helped to propel the company forward and upselling these additional products to existing customers has been a big part of the company revenue strategy.

Box CEO Aaron Levie stated during the earnings call with analysts that the approach was paying dividends. “As we discussed last quarter, our focus is on driving deeper, more strategic relationships with our customers, resulting in higher growth and big deals,” Levie said.

Keeping it on the upswing

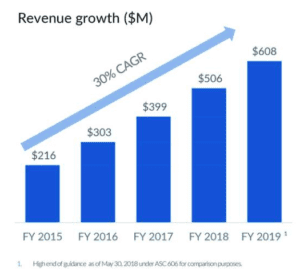

The strategy seems to be working as the company announced $140.5 million in total revenue. That’s a 20 percent year-over-year increase, which projects to $608 million in total revenue for the year as it makes its march towards the billion mark.

Chart: Box

Some have questioned over the years the amount of money that Box has to spend to get new customers and retain existing ones, but the marketing spend numbers appear to be headed in the right direction, according to Box CFO, Dylan Smith.

“Q1 was another successful quarter of driving operational efficiency generating leverage across all areas of the business. Sales and marketing expenses in the quarter were $68.9 million representing 49 percent of revenue, an improvement from 54 percent in the prior year…,” he explained during the earnings call.

Two numbers worth looking at are churn rate, the number of customers that don’t renew and retention rate, the number that do. The former, which is supposed to be a low number is 4.5 percent. Meanwhile the latter, which is supposed to be a higher number is an impressive 109 percent.

Regardless, the company continues to grow and as it expands the number of products services on the platform, it only makes sense that it will build on their success as they draw in existing customers and attract new ones — and maybe cross that billion dollar revenue mark in the next couple of years.

Photo of Box’s Aaron Levie by TechCrunch on Flickr. Used under CC by 2.0 license